By Mike Wagner

In the past, self storage has been touted as one of, if not, the best asset class in all of commercial real estate. Some may wonder if that’s still true with all the changes we’ve endured over the last 12 months. I’d suggest that self storage remains the number one asset class on the planet despite (or perhaps in some ways, because of) all the changes we’ve all experienced recently. There’s evidence wherever we look for why this is the case. In this article, I will briefly touch on several of the advantages that self storage has over other asset classes as well explore how current events are impacting our industry. Doing so will then allow us to transition into what I would suggest may be the more important consideration when it comes to using ordinary garages to create an extraordinary life.

I’ve been in Lifeonaire for about 4 years now and have come to realize that having a VISION is an essential part of living a fulfilled life. One’s Vision is essentially their road map to true success. After dialing in our road map and ensuring that our stage two financial needs are met, an important next step is to choose a vehicle to advance us toward our Vision. For me, that vehicle is self storage investing and I’d love to help you decide if it might be a good option for you. Toward that end, I offer you the following.

What is it about storage that makes it so attractive to investors? Lots of things. Storage is both physically and conceptually simple. Physically, there’s a concrete floor, metal walls and roofs plus one rolling door per unit. As such, it’s pretty easy to maintain this asset. And from a conceptual standpoint, the idea with storage investing is the same as with any other rental based investment; buy low, rent it out to maximize revenue/profits and sell high (or hold for long term cash flow). That’s just a lot easier to do in storage because we are not faced with the physical and operational complexities inherent in other asset classes. By streamlining our investing, there’s more time left over to dedicate to the more important things!

Perhaps an even greater advantage enjoyed by storage owners and investors is the legal realm within which we operate. Rather than enduring the often painful process of eviction and foreclosure that plagues so many landlords and multi-family investors, storage investors are fortunate to fall under the governance of lien laws. As a result, proper handling of collections and delinquencies is far easier for storage owners. And while this has always been true, it’s more true today than it ever has been. In response to COVID, several states have enacted moratoriums on evictions making it even harder for landlords to collect the rent that is rightfully theirs. Storage investors, on the other hand, are benefiting from loosening restrictions and streamlined collection procedures. More and more states are allowing storage investors to serve lien notices via email rather than through certified/registered mail. The end result of all this, is that the operational efficiency enjoyed by storage owners is growing.

The COVID-induced culture wide transition to “contact-less” commerce is also proving to be quite beneficial to storage owners. While many investors, myself included, have been successfully deploying unmanned, remote management strategies within the storage industry for several years, our current circumstances have accelerated the adoption of such practices within the industry and amplified the benefits of such practices for both storage investors and storage customers.

As compelling as my assertions above may be, do the numbers tell the same story? Let’s take a look. Obviously the numbers will differ from market to market but, by and large, the expense ratios in self storage (as you very well may know) hover around 30-35%, meaning that 30-35% of gross income is used to cover operating expenses. This leaves 65-70% to cover debt service. Anything left after that is profit in the owner’s pocket. Compare this fundamental financial truth with the 50-55% expense ratios seen with apartments and it’s easy to see why storage has potential. There’s an extra 20 cents from every rental dollar available for the investor to use as they see fit. With this in mind, it becomes much easier to understand why mortgages backed by self storage properties default less often than mortgages backed by any other asset class!

As compelling as my assertions above may be, do the numbers tell the same story? Let’s take a look. Obviously the numbers will differ from market to market but, by and large, the expense ratios in self storage (as you very well may know) hover around 30-35%, meaning that 30-35% of gross income is used to cover operating expenses. This leaves 65-70% to cover debt service. Anything left after that is profit in the owner’s pocket. Compare this fundamental financial truth with the 50-55% expense ratios seen with apartments and it’s easy to see why storage has potential. There’s an extra 20 cents from every rental dollar available for the investor to use as they see fit. With this in mind, it becomes much easier to understand why mortgages backed by self storage properties default less often than mortgages backed by any other asset class!

Taking what we’ve covered above (which is really just scratching the surface), it becomes pretty clear that storage can be an incredibly powerful investment vehicle. While the world might perceive what I am about to say as a pretty hard counter-cultural pivot, Lifeonaires “Get It”. That said, I think it bears repeating as often as we have the opportunity.

Just because storage is a great investment, doesn’t mean that it will automatically make you rich. And if it does provide you all the money you could ever need, that may or may not allow you to create the extraordinary life that you deserve. It can, but whether or not it does, will depend on you. For one, storage is not mailbox money (at least not at first). It’s a business and deserves to be treated like one.

There’s no doubt that storage has the power to provide us with a level of financial security and freedom that few others enjoy. I’ve seen it happen time and time again. Generating the profits is only half the equation though. What we do with those profits is just as important. It’s been said, and supported by mounds of statistical evidence, that making more money does not necessarily bring happiness. More specifically, studies show that as income increases toward $70,000 annually, happiness levels do increase. Beyond that though, the extra income does not provide for increased levels of happiness. Just because increases above $70,000 don’t automatically enhance happiness, does not necessarily mean that they can’t! So how do we ensure the money we make (whether it comes from storage or elsewhere), actually moves our happiness needle? Read on to find out!

Money is an incredibly powerful tool. Its ability to provide us with an extraordinary, Vision centered life filled with happiness depends on how we use it though. A hammer can secure a nail if used properly. And it can also put a giant, unwanted hole in your wall if you’re not careful. The same applies to our storage profits. I’d argue that the money we make in storage can indeed help us create extraordinary lives and produce the kind of happiness that we all want. ‘How we use our money’ though, will ultimately determine whether or not that actually happens. Too many folks get into real estate with the idea that doing so will magically give them a life of freedom. What they neglect to consider though is that such a life requires an intentional design and disciplined execution.

If our lifestyle grows as fast (or faster than) our storage profits, that feeling of security and freedom that we are all after will elude us. If instead though, we focus on increasing the gap (or margin) between how much money we make and how much money we spend, our lives can become increasingly extraordinary. Now please know that I am not suggesting that we should all live like paupers. I may spend 6 months per year traveling around the country in an RV with my family but I am not suggesting that you should be living in a van down by the river! Instead, I am simply reminding us all (myself included) that our freedom, and the subsequent happiness that such freedom offers us, depends more on how we use our money than it does on how much money we make.

If our lifestyle grows as fast (or faster than) our storage profits, that feeling of security and freedom that we are all after will elude us. If instead though, we focus on increasing the gap (or margin) between how much money we make and how much money we spend, our lives can become increasingly extraordinary. Now please know that I am not suggesting that we should all live like paupers. I may spend 6 months per year traveling around the country in an RV with my family but I am not suggesting that you should be living in a van down by the river! Instead, I am simply reminding us all (myself included) that our freedom, and the subsequent happiness that such freedom offers us, depends more on how we use our money than it does on how much money we make.

True happiness, I believe, is when the way we spend our time and money is in alignment with our deepest values. We can, by investing in self storage, create levels of financial security and freedom that few people will ever experience but that doesn’t just happen automatically or by accident. It requires that we define what our own personal definition of success is. The world defines success as a faster car and a bigger house. And while there is nothing wrong with either of those two things, I’d invite you to consider how we might be able to better use our storage profits. Could we use them to enhance the relationships that we have? To invest in our own personal development? Or to contribute more to others? For these three areas, relationships, growth and contribution are where true happiness, and an extraordinary life, lay.

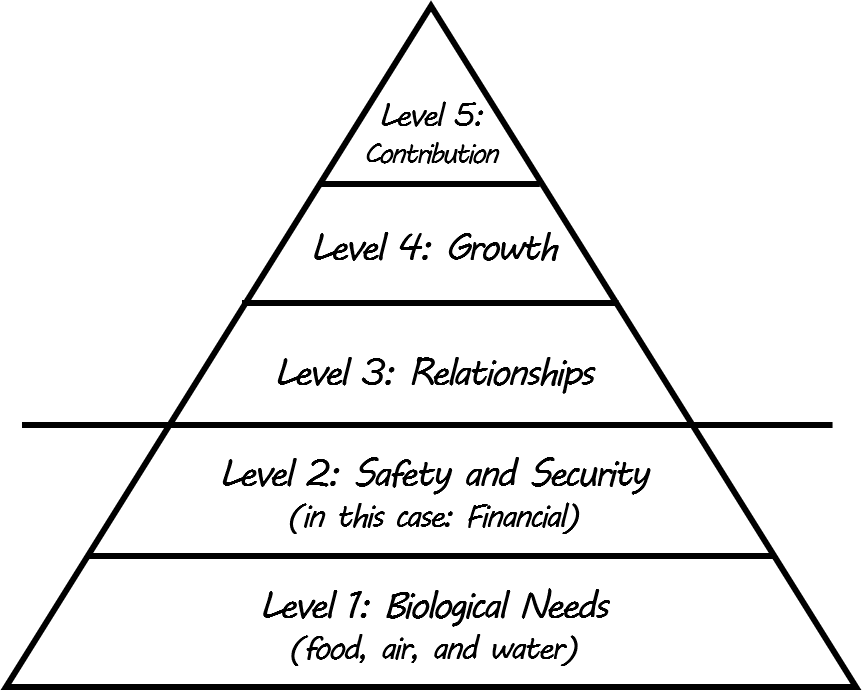

It’s been said that we, as humans, have a tendency to ‘over-satisfy’ our basic needs (as modeled by Maslow in his Hierarchy of Human Needs) as a way to compensate for unmet higher level needs. Perhaps a quick illustration will help here. Here’s an adapted few of Maslow’s Hierarchy of needs:

I believe many storage investors fail to achieve the level of happiness that they set out to achieve because they get stuck at level two in the pyramid above. They over-satisfy level two (financial needs) in an attempt to fulfill their unmet higher needs. What I shared in the preceding paragraphs is, in my humble opinion, the key to getting unstuck and ascending up through levels three, four and five toward a life of TRUE Fulfillment.

Ask anyone who’s achieved financial success and they will tell you that doing so is NOT the same as achieving true fulfillment. That’s not to say that financial success should be avoided. Instead, I’m suggesting that we should all strive to parlay our financial success into true fulfillment. And that requires that we focus more on the gap between what we make and what we spend, than on just what we make.

I realize we’re ending this article a long way from where we started and I hope that you found some value. Self storage has provided me with an extraordinary life and I am beyond grateful for that. What I learned along the way though, is that the profits are only the first half of the equation. What I shared above is the second, and arguably, more important half of the equation. I hope you’ll at least consider whether any of what I have shared here can help you claim the extraordinary life that is available to all of us! And I’d be honored to guide you along the way if I am able. Stay tuned for some super exciting news in the coming weeks. Lifeonaire and the Storage Rebellion have teamed up to give to you an incredible opportunity to explore the ideas I shared above in far greater detail.

Gratefully In Your Service,

Mike

________

BIG P.S. One of Mike’s most successful students who has transformed his life through storage investing, is holding an open Q&A call on storage Wed Feb 10th at 10:00am EST. On the call you’ll be able to learn exactly what he did and how you can do the same. Mark your calendar now and be on the lookout for call registration details.

________

About Mike Wagner

After a short stint as a profitable but overwhelmed landlord, Mike made a dramatic transition to self storage in 2011. He generated over $1.5 million on his first self storage deal. And thanks to Lifeonaire, was able to use that success as a way to create “space” in his life. The space that he used curated a well thought out, intentional, Vision-based life of Awesomeness. He’s continued to invest successfully and now owns a free and clear self storage portfolio that offers his family an inordinate level of freedom. In recent years, his focus has shifted to helping others achieve similar results. He started the Storage Rebellion in 2018 which has quickly become the premier self storage training organization/community in the country!