Four Stages of Financial Prosperity

Watch This First

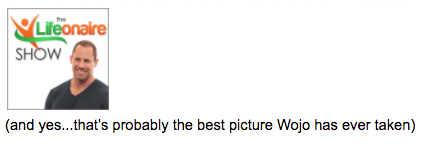

Some candid feedback:

“My mind is kind of blown. What I was expecting: A fancy, new spin on some already familiar ideas on ‘prosperity’ I’ve heard before. What I got instead: My eyes opened for the first time to a ridiculously simple-yet-powerful blueprint (in 4 steps) for designing a truly prosperous life. It’s not the ingredients themselves that are magical—it’s the underlying principles, values, and sequence in which you combine them that’s so special and cracks the code on how to design a truly prosperous life. Bottom line, this is a game changer for me.”

Get ready for a ride—and brace yourself, this might mess you up (in a really good way 🙂 ) …

You have described what has happened to me. I was a federal law enforcement special agent. I had to retire at age 57 which is federal law for federal agents. I did not have assets accumulated to enjoy the life style I wanted, so I invested in real estate programs. I bought too many programs and made two bad deals on properties I rehabbed. I did it on hard money loans and the properties did not sell for a year during which time I had to carry them costing a lot of money. I did make about $20,000 on one of those, but of the second one I had to bring $5,000 to the closing table. I am doing government contract work and am paying my accumulated credit card debt with everything I am earning doing the contract work. I am working on the CLEAN UP STAGE. I saw you guys at Jane Garvey’s REIA session for one or two days. I bought in but have not had enough money to invest yet until I get “excess cash”. I didn’t know how good I had it before I invested in real estate investing. I wish I could go back to the beginning knowing what I have learned and know now.

Love what you guys are teaching and would love to learn more.

The only question I would have pertains to the debt free investing as I have always heard that can set you up for law suits.

Thanks for the video. I was hoping you could clear up some confusion for me. In stage 1, it’s my understanding that we need to lay out our plan for just our “needs” and it represents our “needs” at that time. That makes sense. But in stages 3 or 4, you mentioned that we should not be adding more debt later, in order to keep our “needs” the same. Are you suggesting that in the strictest sense? It’s hard not to imagine a time later in life that our “needs” have grown because we’ve incorporated some “wants” into the needs because we can easily afford to do so. Sorry…I’m just trying to REALLY make sure I nail down exactly what my “needs” are for stage 1 and whether or not I should consider anything past today?

Thank you! I am grateful for you. You, Lifeonaires. I just met my first Lifeonaire Wednesday, originally scheduled to discuss a RE deal. However, in the 7 days between meeting this Lifeonaire for the first time and meeting him for the second time Wednesday… my whole focused had shifted, divine intervention, and I was questioning the deal. It was a set up, right? Not wanting to cancel the appointment, but not wanting to waste anyone’s time, I prepared to move forward with the deal, if that is how it flowed. We never crunched a single number. He asked me “Why do you want [to buy] an apartment building?” “why”. The word rang out in my brain as if God was nudging me, “yea, daughter, why do you want that? DO you want that?” No, what I WANT is freedom and I was hoping an apartment building would buy me freedom. I believe the Lifeonaire/Investor knew it, too. He gave me the book. Since reading the entire book THAT night after our meeting, discussing it with my husband, listening to the intro video, and now the 4 stages of Financial Prosperity call, I am hopeful again. JUST as we were when we first got into real estate… aahhh…. this stuff is great! But, like so many, we too drank the Kool-Aid and now– making 20 TIMES what we were when we got into real estate– Still not free. YET! So grateful for the Stages and super encouraged to get going on my plan. I can’t say thank you enough!

Putting the pieces together. I was going around in circles and now I know what was keeping me stuck. The book was awesome and the audio I just listened too fixed my missing piece.

Ready to move forward. This time I will start at the beginning and get clear on what it is I am doing and why first.

Thanks for the help. I will be spreading the information to many others. Starting with my daughter and my teenage granddaughter. Might as well, start her now, before they brainwash her into debt.

What helped me most was creating a budget… I know where every nickel is spent since 2011…perfect for stage one and two…

It changed my life… I sleep like a baby every night